Suspicious Uzbek investments. How Russia uses Central Asia in the war against Ukraine

Uzbekistan and Kazakhstan significantly increased their export of cotton and its derivatives to Russia during 2023-2024. This plant is used in the production of gunpowder, which is then used to create ammunition, shells, and rockets for Russia’s war of aggression in Ukraine.

Russia receives various forms of support in its war against Ukraine. Well-known collaborations include those with Belarus, Iran, North Korea, and China. However, there is a region that rarely gets attention from major media outlets or analytical centers.

In this article, Svidomi describes how Russia is finding ways to circumvent sanctions, fuel its military machine and support its businesses by using the post-Soviet states of Central Asia.

This article was published as part of the special project 'How Russia Undermines World Order'.

Relations between Russia and Central Asia

Central Asia, in the modern understanding of the term, includes the following countries: Kazakhstan, Turkmenistan, Uzbekistan, Tajikistan, and Kyrgyzstan — all former Soviet republics. Throughout their years of independence, these countries have maintained relatively close relations with Russia and continue to do so. All of them are members of the CIS (Commonwealth of Independent States), and Kazakhstan, Kyrgyzstan, and Tajikistan are also members of the CSTO (Collective Security Treaty Organization) — Russia's version of NATO.

These countries take a noticeably neutral position in Russia's war with Ukraine. They call for an immediate cessation of hostilities in Ukraine but do not specify that Russian troops should be withdrawn from Ukrainian territory, as reported by the Center for International Security. Furthermore, none of the Central Asian countries supported any of the six UN General Assembly resolutions calling on Russia to withdraw its troops from Ukrainian territory.

In 2022, President Tokayev of Kazakhstan stated:

"... we are strategic partners with Russia. We are members of the same organisations. Therefore, our goal is to remain in close contact with Russia to strengthen our mutual cooperation both bilaterally and in relevant international organisations."

Central Asian countries also cooperate directly with Russia's military-industrial complex. According to the US State Department, Kazakhstan's national company 'Tynys', Uzbekistan's 'Promcomplektlogistic' and Kyrgyzstan's 'Dastan' supply Russia with components for the production of aircraft, helicopters and other aviation equipment. These are just some of the companies and other institutions in Central Asian countries that are directly supporting Russia's military-industrial complex in its war against Ukraine.

At the same time, Kazakhstan and Uzbekistan provided humanitarian aid to Ukraine in 2022, and Kazakhstan, Uzbekistan, and Kyrgyzstan prohibit their citizens from participating in the current war and warn of criminal penalties, including property confiscation, for such actions, according to Turkish media outlet Anadolu. The official website of the Oliy Majlis (Uzbekistan's parliament— ed.) also reports that the country's government has decided to join sanctions against Russia to avoid the possibility of Russia weakening their effect through secondary exports.

Relations between Central Asian countries and Russia have also deteriorated somewhat. According to The Conversation, after the Crocus City terrorist attack by Tajik citizens, Russian police began deporting workers from across the region. This has not helped good neighbourly relations with these countries. In addition, Central Asian countries, except Turkmenistan, have accepted and continue to accept Russian citizens fleeing mobilisation into the Russian armed forces. According to The Diplomat's sociological data, 49% of Kyrgyz and 43% of Kazakhs blame Russia and its attack on Ukraine for the economic problems in their countries.

It is impossible to say that the Central Asian states are full-fledged allies of Russia. The relations between these countries and Russia are rather strained and resemble a weather vane. However, it is worth remembering that they do help Russia, and the latter uses the states of this region in the following ways:

1. Export of cotton for gunpowder production

Cotton is one of the main components used to produce nitrocellulose, the gunpowder base. Of course, this compound is also used in dozens of other fields, such as medicine, construction, paints, and more. This fact allows Russia to freely purchase cotton and its derivative nitrocellulose from Central Asian countries.

Ekonomichna Pravda reveals details of how this compound ends up in Russia. It is exported through local Kazakh and Uzbek companies to Russian intermediary companies, many of which often have no business history or whose activities are nearly impossible to trace. Three larger Russian companies — Bina Group, Khim-Treid, and Lenakhim — bought and imported cotton and nitrocellulose, later reselling it to Russian military factories.

The leading exporters to Russia among these countries are the Kazakh company Khlopkoprom and the Uzbek companies Raw Materials Cellulose and Fergana Chemical Plant. Russians Mikhail Glukhov and Rustam Muminov own the latter.

As a result, the products from these suppliers end up in Kazan, Tambov, and Perm gunpowder factories — strategic enterprises in Russia that produce ammunition for small arms, various types of bombs, air defence missiles, anti-tank guided missiles, and Grad and Smerch systems, which are actively used to shell Ukrainian front-line regions and the front itself.

2. Sanctions evasion and secondary exports

There are two ways to evade sanctions in Russia: legal and semi-legal. The legal way involves buying and dismantling household appliances containing electronics, which can be used in simple weaponry. The Washington Post reported cases where parts from refrigerators and industrial machinery were found in Russian tanks.

The semi-legal method involves purchasing necessary equipment from neutral intermediary countries, as seen in the case of Kazakh and Uzbek cotton. However, it's not just cotton. Exports of semiconductors, which are used in various technologies, including military applications, have increased tenfold. The primary countries involved in this trade are Kazakhstan and Kyrgyzstan. Bloomberg reports that, according to Geneva Trade Data Monitoring, exports of this equipment from Kazakhstan — despite lacking the capacity to produce it — rose from $12,000 a year to $3.7 million in 2022, an increase of more than 3000%. A similar trend is evident in Kyrgyzstan and countries outside Central Asia, such as Türkiye, Armenia, and the UAE.

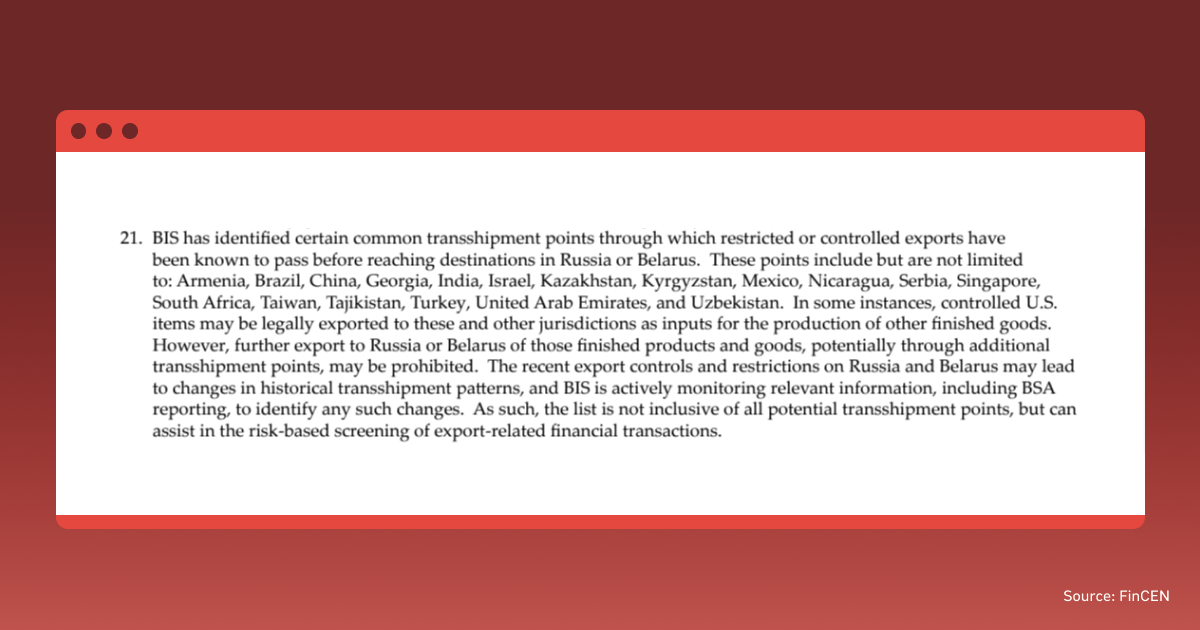

The U.S. Department of the Treasury’s Financial Crimes Enforcement Network included Kazakhstan, Uzbekistan, Kyrgyzstan, and Tajikistan in its list of countries that help Russia circumvent sanctions as early as 2022. However, this does not prevent, for example, Kazakhstan's state company KazMunayGas from cooperating with Russia in repairing and supplying the CPC (Caspian Pipeline Consortium), which is not under Western sanctions, thanks to lobbying by Chevron Corporation, the second-largest U.S. energy company. Adastra Fellows claims that this company is interested in keeping the CPC off the sanctions list, as it uses the pipeline to export Kazakh oil to the West. The Center for Transport Strategies provides data showing that the American company still owns 12.5% of CPC shares.

One of Russia's key partners in circumventing sanctions is Uzbekistan, according to Radio Ozodlik, the Uzbek outlet of RFE/RL. Many Russian companies open their branches or joint Russian-Uzbek companies to bypass sanctions in this country. For example, Russian AvtoVAZ and KAMAZ, through cooperation with the Uzbek government and its state companies, are completing their products with Western components.

This active cooperation between Russia and Uzbekistan is particularly worrying in the context of the following section.

3. Suspicious investments from Central Asia

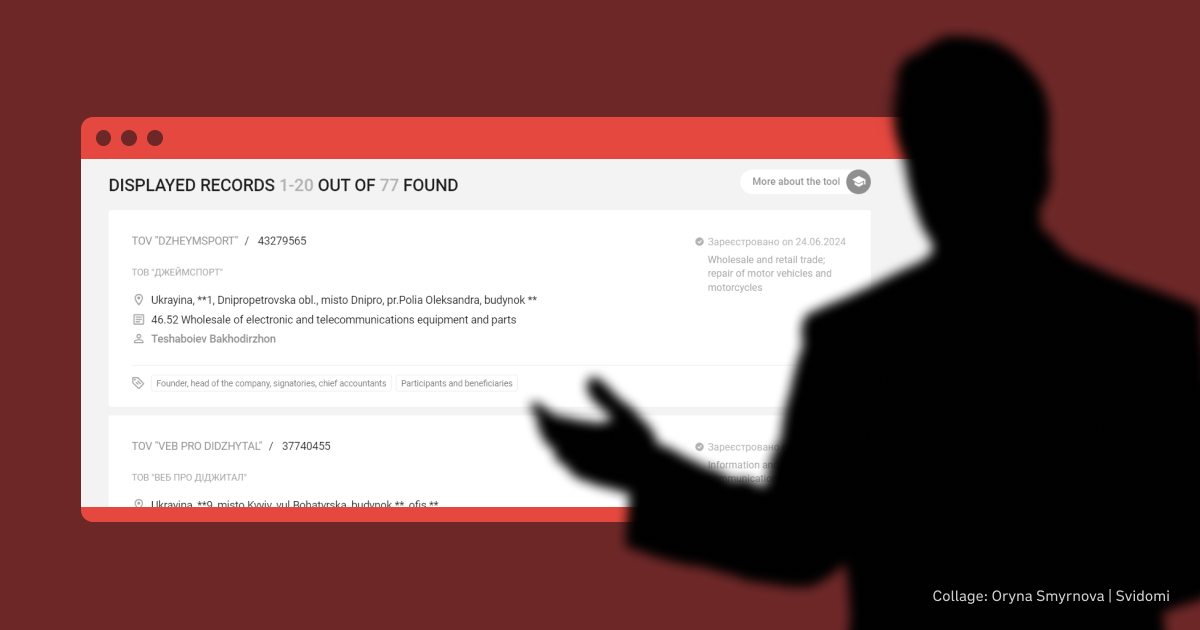

Svidomi, in collaboration with YouControl, analysed hundreds of Ukrainian companies that acquired Uzbek beneficiaries after February 22, 2022. According to YouControl — analytical system for verifying counterparties — over 1500 Ukrainian companies now have Uzbek citizens in their ownership structure.

An interesting case is that of Bahodirjon Teshaboyev, who is listed as the 'founder' in the documentation of 57 companies in Ukraine. One of these companies, LLC 'MVP Energosolutions', won a tender worth over 197 million UAH to construct protective structures at the Dnipro HPP. Details of this contract are unknown; it was awarded without a competitive bidding process, and the justification for the tender is 'Ukrainian Liberation War', as reported by the media outlet Nashi Hroshi.

Bahodirjon Teshaboyev is also a new 'owner' in companies such as LLC 'IT Comp Prog' and 'BR Trade'. The former provides programming services, while the latter deals in the wholesale trading of metal products. According to YouControl, both companies had historical ties to individuals associated with the Russian Federation. Teshaboyev is also listed as the 'owner' of companies engaged in electrical work, wholesale chemical products, dairy trade, advertising services, oil and animal fat production, web portal management, and more.

There are many such ‘diverse’ investors from Uzbekistan: Bakhtiyor Yuldashev (73 companies) and Otbek Yuldashev (31), Tozhiddin Madraimov (28), Asroriddin Mustafaev (19), Svetlana Orinbayeva (Kazakh, 44 companies), Nurmatzhon Nurmatov (39), and Muhammad Kenjaev (35). All these individuals are new 'owners', with at least one company historically having ties to individuals associated with Russia.

There are many more examples, as, in total, these individuals own 326 out of more than 1,500 companies with Uzbek beneficiaries. The surge in 'investments' began in 2014 when Turkmen beneficiaries appeared in 43 Ukrainian companies, with the peak occurring in 2021 with 392 companies. In comparison, the average number of companies with new Kazakh or Uzbek beneficiaries was 24 per year between 2004 and 2013. From 2014 to 2023, this number increased to 176.

We cannot state that all the new 'owners' of the companies are definitely Kremlin agents or straw men. However, based on the experience of Russia's cooperation with Central Asian countries, especially Kazakhstan and Uzbekistan, it is worrying that these ‘investments’ may contain Russian influence, which could allow Russia to continue to conduct commercial activities in Ukraine.

Is it possible to change anything?

First and foremost, it is crucial to understand that such cooperation between Russia and the Central Asian countries strengthens its military machine and provides resources to continue the war.

There are two main issues regarding countries in this region: the West's passivity in imposing sanctions to limit secondary exports and the insufficiency of Ukraine's foreign policy.

The first problem has long been known and requires more active involvement from Ukrainian partners. Surprisingly, one of the main obstacles on this path is Western companies themselves, as demonstrated by the example of Chevron Corporation and the CPC. Svidomi has already called on Western governments to intensify their fight against Russian influence and to strengthen sanctions against Russia in the article "Russia's network of influence in Europe and North America. How Russia fosters terrorist and political organisations".

The second problem is the inactivity of the Ukrainian government. Russian influence in Central Asian countries is significant, but Ukraine needs to overcome it to improve the situation in the war. A notable example of Russian influence and Ukrainian inertia is the non-appointment of Serhii Haidai — former head of the Luhansk Regional Military Administration — as ambassador to Kazakhstan. In 2023, according to Deutsche Welle, the Kazakh government refused to grant Haidai agrément (the preliminary consent of a government to accept a particular person as the head of a diplomatic mission — ed.). As of now, Ukraine still does not have an ambassador to Kazakhstan, only a temporary chargé d'affaires, Serhii Pavlenko, which does not facilitate intergovernmental contacts.

The situation is even worse in relations with other countries in the region, as since the full-scale invasion, the President of Ukraine has only had phone calls with the President of Kazakhstan, Tokayev.

In the absence of Ukrainian international activity in the region and more active involvement of Ukraine’s Western partners, Russia will continue to use these states as a window of opportunity to circumvent sanctions or mitigate their impact on its economy, industrial, and military sectors.