Do Ukrainian attacks on Russian refineries impact the oil and fuel products market?

What happened?

Ukraine began attacking Russian oil refineries in February 2024. These operations were carried out by the Defence Intelligence of Ukraine (DIU) and the Security Service of Ukraine (SSU), Suspilne reported. They used Ukrainian-made attack drones capable of flying almost a thousand kilometres into Russia. Most Russian refineries are in the European part of the country, so the Ukrainian military could reach them with these weapons.

The largest attack was carried out by Ukrainian special services in March when they simultaneously attacked three Russian refineries in Ryazan, Nizhny Novgorod and Leningrad regions. Ukraine managed to freeze 12% of the Russian oil refining industry, as reported by Bloomberg.

Ukrainian strikes on Russian refineries have already led to a reduction in fuel production in the country. According to Reuters, Russia has been importing fuel from Belarus since March.

In March, the FT reported that the White House had called on Ukrainian security services to stop attacking Russian refineries, fearing rising prices on the global fuel market.

“The White House had grown increasingly frustrated by brazen Ukrainian drone attacks that have struck oil refineries, terminals, depots and storage facilities across western Russia, hurting its oil production capacity,” the FT sources reported.

On March 23, Ukraine conducted the last confirmed strike on a Russian oil refinery, this time in the Samara region. Ukraine also allegedly attacked the Novoshakhtyn refinery in the Rostov region on April 10.

What do the US authorities say?

On March 26, the US made its first public comments on Ukraine's attacks on Russian refineries. State Department spokesman Matthew Miller made the statement.

“Our position since the outset of this war has always been that we do not encourage or support Ukraine taking strikes outside its own territory,” he said.

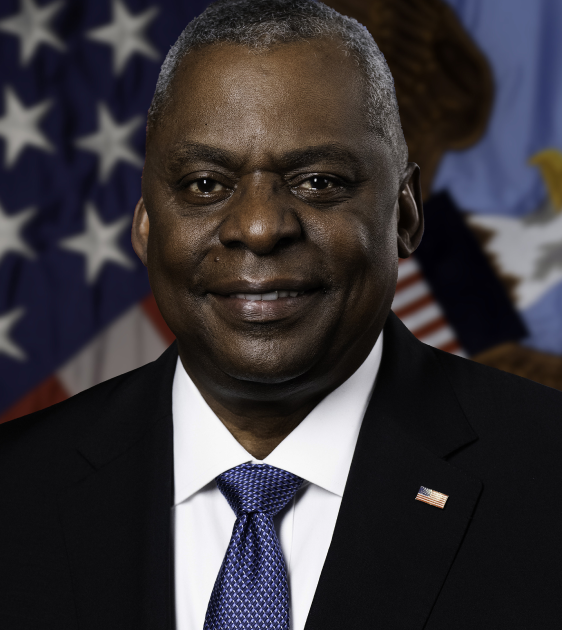

In April, US Secretary of Defence Lloyd Austin criticised the Ukrainian attacks. In his speech to the Senate, he said that the strikes on the refineries could affect the energy market and urged Ukraine to focus on military objectives.

Those attacks could have a knock-on effect in terms of the global energy situation. Ukraine is better served in going after tactical and operational targets that can directly influence the current fight,

Austin said.

Republican Senator Tom Cotton criticised Austin's statements in response, arguing that “the Biden administration does not want to see fuel prices go up in an election year”.

US Assistant Secretary of Defence for International Security Affairs Celeste Wallander said at a meeting of the Congressional Armed Services Committee in April that the administration was concerned about Ukraine's attacks on oil refineries because they are critical infrastructure and civilian targets.

“Ukraine holds itself to the highest standards of observing the laws of armed conflict, and that's one of the elements of being a European democracy,” Wallander explained.

Austin Scott, a Republican congressman, criticised the statement of the Assistant Secretary of Defence and said that “Russian oil refineries are military targets” for Ukraine.

What is happening in the global oil and fuel market?

Oil prices rose in March and continue to rise. Brent crude oil prices are currently trading at $92 per barrel, up 2.7% from February, Bloomberg reports. Analysts attribute this rise to events in the Middle East and a possible Iranian strike against Israel in response to the Israeli attack on the Iranian consulate in Syria. On April 12, the Lebanese group Hezbollah attacked Israel.

Back in February, the OPEC+ countries (OPEC members Algeria, Ecuador, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the UAE, Venezuela, and non-aligned Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Oman, South Sudan, Russia, and Sudan — ed.) back in February agreed to cut oil production “to stabilise market prices”. Saudi Arabia reduced production by as much as 17.6% in the fourth quarter of 2023, even before the agreement.

Petras Katinas, an analyst at the Centre for Research on Energy and Clean Air (CREA), in a comment to Svidomi, confirms the link between rising oil prices and events in the Middle East. According to him, the attacks on refineries have no impact on these market developments.

Drone attacks target only oil refineries; thus, they do not directly impact Russian oil exports. If drones were to target pipelines, terminals, or carriers, the price impact would likely be more substantial,

said Petras Katinas.

Russian Urals oil is also sold at a price above the sanctioned price. According to the sanctions imposed on Russia by the G7 countries, its oil should be sold for $60 per barrel. In April, Russia sold its oil for $75 a barrel.

Petras Katinas explains that Russia is now exporting more crude oil to the world market because of the attacks on refineries.

“We have seen a rise in Russian crude oil exports in March. This shift could occur if Russia faces challenges rebuilding its damaged refinery capacity, compelling it to prioritise crude oil exports instead,” says Petras Katinas.

In March, however, Russia managed to keep its exports of oil products at the same level as before the massive attacks and capacity losses. Petras Katinas believes that Russia's product stocks are the main reason for this. Russia could also have restored some of its capacity or even prioritised exports over the domestic market. The latter two scenarios are hardly possible as Russia cannot restore the damaged refineries, Reuters reports. For example, Lukoil cannot buy turbines for its plant from US engineering firm UOP.

According to the analyst, “there will be a decline in exports of oil products from Russia” in April.

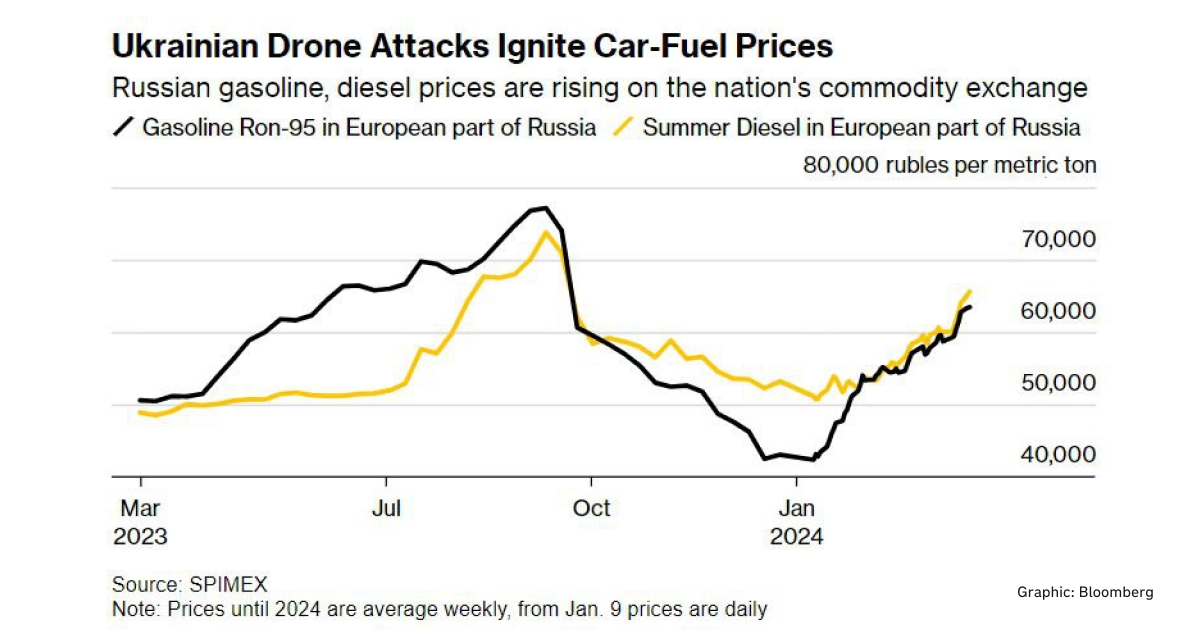

The Ukrainian attacks on Russian refineries have had a direct impact on the Russian domestic market. Petras Katinas tells Svidomi that petrol production in Russia has fallen by 9% and diesel by 16%. Reuters confirms this data, reporting that Russia is importing diesel from Kazakhstan to make up for the shortfall in the domestic market.

Russia also keeps a lid on retail fuel prices to avoid panic among the population.

“Russian authorities exert pressure on oil traders to maintain current price levels despite the production challenges caused by the attacks,” says Petras Katinas.

There are no sharp jumps in the global market for petroleum products, including diesel. According to Business Insider, the price of diesel rose by 1.6% in February and has remained at that level since. In the United States, the cost of petrol rose by 24 cents in March and is now $3.63 per gallon (1 gallon is 3.7 litres — ed). In other words, there has been no sharp rise in the price of either oil products or oil itself.

It is impossible to predict whether Russia can expect a long-term shortage of oil products, including fuel. After all, the country still has refineries in the Asian part of the country beyond the Urals.

In response to drone strikes, Russia might subcontract factories outside the Urals region. However, this alternative could introduce logistical complexities, increase costs, and create gaps in the supply chain due to longer transportation routes,

concludes Petras Katinas, an analyst at the Centre for Research on Energy and Clean Air (CREA).

Ukrainian President Volodymyr Zelenskyy confirmed in a commentary in the Washington Post on March 30 that the response of the Biden administration to the Ukrainian attacks was not positive. And Ukraine had used its drones, not US weapons, which Ukraine is not allowed to use on Russian territory.

“If there is no air defence to protect our energy system, and Russians attack it, my question is: Why can’t we answer them? Their society has to learn to live without petrol, without diesel, without electricity… It’s fair,” the President emphasised.